Silicon Motion Technology (SIMO)·Q4 2025 Earnings Summary

Silicon Motion Crushes Revenue Estimates, Stock Surges 9% on AI Chipmaker Deal

February 4, 2026 · by Fintool AI Agent

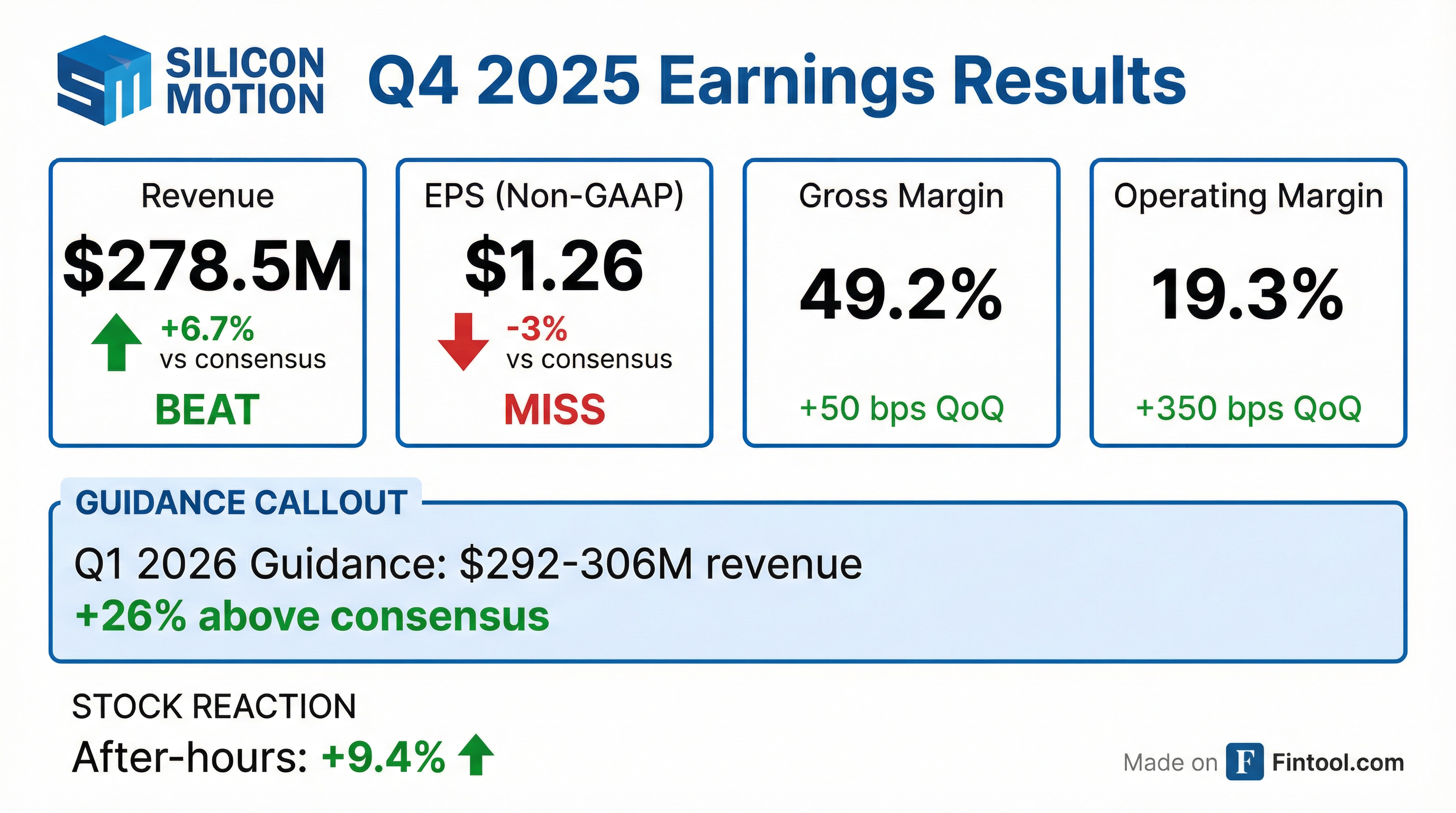

Silicon Motion delivered a revenue beat and raised the bar for Q1 2026, sending shares surging over 9% in after-hours trading. The NAND flash controller specialist reported Q4 revenue of $278.5 million, topping the Street's $261 million estimate by 6.7%, though non-GAAP EPS of $1.26 came in slightly below the $1.30 consensus.

The real catalyst: Q1 2026 guidance of $292-306 million—a midpoint 26% above analyst expectations—and the disclosure that Silicon Motion is entering production with a "leading AI chipmaker" for DPU server boot drive solutions.

Did Silicon Motion Beat Earnings?

Revenue surged 15% sequentially and 46% year-over-year, driven by strong demand across all three product lines. The slight EPS miss was primarily due to higher R&D investment (+45% YoY) as the company ramps next-generation PCIe Gen5 and enterprise controllers.

For full-year 2025, Silicon Motion generated $885.6 million in revenue (+10% YoY) with non-GAAP EPS of $3.55 (+5% YoY). Gross margin expanded 230 basis points to 48.3% as the product mix shifted toward higher-margin controllers.

What Changed From Last Quarter?

The quarter marked several inflection points for Silicon Motion:

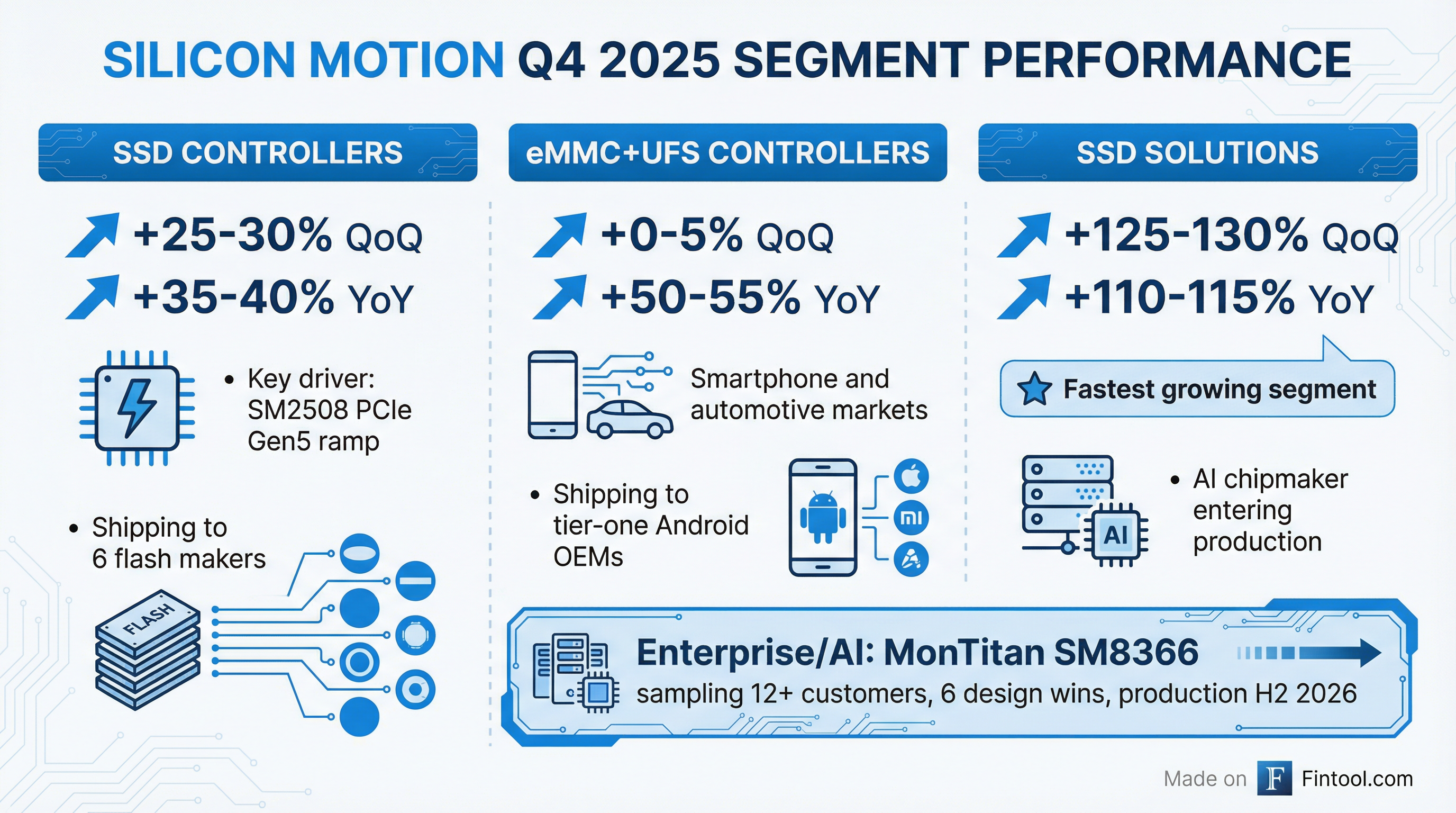

SSD Solutions Exploded: The fastest-growing segment surged 125-130% sequentially and 110-115% year-over-year, reflecting new customer wins and expanded production volumes.

AI/Enterprise Breakthrough: The company disclosed it is "entering production with the leading AI chipmaker in the current quarter" for DPU server boot drive solutions—a significant design win that opens Silicon Motion to the explosive AI infrastructure buildout.

PCIe Gen5 Momentum: The SM2508 high-performance controller achieved 15% of client SSD revenue in Q3 2025 and continued ramping in Q4. The mass-market 4-channel SM2504XT launched in Q4, targeting mainstream PCs.

Segment Performance Highlights:

The eMMC+UFS business showed flattish sequential growth but maintained strong year-over-year momentum, benefiting from smartphone market recovery and automotive expansion.

What Did Management Guide?

Q1 2026 guidance came in dramatically above Street expectations:

The 76-84% year-over-year revenue growth implied by guidance reflects the full ramp of PCIe Gen5 controllers and the AI chipmaker production win.

Long-Term Targets remain unchanged:

- Gross Margin: 48-50%

- Operating Margin: 25%+

- Continued robust growth

How Did the Stock React?

Silicon Motion shares closed the regular session at $120.42 (+0.6%) before surging to $131.66 in after-hours trading—a 9.4% gain from the regular close.

The stock has been on a tear heading into earnings:

- +28.7% over the past month

- +223% from the 52-week low of $37.21

- Trading near the 52-week high of $127.67

Historical Beat/Miss Pattern: Silicon Motion has beaten consensus estimates in 7 of the last 8 quarters, with an average EPS surprise of +15%.

Q&A Highlights: What Management Said

On 2026 Segment Mix Targets:

"Mobile controller, eMMC UFS, is a bigger one, and it will exceed probably about 35%-40% of our total company revenue... Enterprise controller definitely grow much faster. BlueField also is new to us."

On Boot Drive Revenue:

"We see this year, revenue relatively around $50 million, but I think next year will be much higher... BlueField 3 is primary for this year, but BlueField 4 and the NVLink and the Ethernet features is for second half and really more volume in 2027."

On MonTitan Revenue Contribution:

"We remain confident that MonTitan will ramp to represent at least 5%-10% of revenue exiting 2026, and should experience further success in 2027 and beyond."

On PC Market Outlook:

"2026, PC unit shipment will decline 5%-10%... PC OEM now face the price increase quickly. So I think from value line, many would de-spec the storage product."

On NAND Supply Dynamics:

"AI CSPs have attempted to lock up all the DRAM and NAND supply through 2026, which has made it increasingly difficult for other market players to get product."

On Chinese Competition:

"Chinese controller maker, they will have a tough time to secure TSMC advanced technology now... to go beyond 12 nanometers, like 7, 6 nanometer, you have to be applied and to be approved by TSMC or Samsung."

Enterprise/AI: The MonTitan Opportunity

The MonTitan SM8366 represents Silicon Motion's biggest growth opportunity:

- Revenue Target: 5-10% of company revenue exiting 2026

- Sampling: Over 12 target customers including Tier-1 datacenter operators, NAND flash makers, and module partners

- Design Wins: 6 customers secured; PCIe 6 version already has design wins with multiple Tier One customers

- Production Timeline: TLC compute SSD qualification ongoing in H1 2026, commercial ramp in H2 2026

- Target Markets: QLC-based "warm storage" and TLC-based "compute" SSDs

- Next Gen: 4-nanometer PCIe 6 MonTitan tape out planned for Q2 2026, targeting 2027-2028 ramp

The SM8366 is the industry's first QLC-based Zone Namespace SSD controller, featuring MonTitan PerformaShape technology with 2,400 MT/s NAND interface, 14GB/s sequential read, and 3.5M IOPS random read.

Boot Drive: The BlueField Opportunity

Silicon Motion is building a significant enterprise boot drive business:

The company began volume shipments to the leading AI GPU maker in Q4 and is qualifying next-gen DPU and switch products launching H2 2026.

Capital Allocation

*Dividend was discontinued in 2023 due to the MaxLinear merger agreement (since terminated).

The company declared an annual cash dividend of $2.00 per ADS for 2025. Operating cash flow declined as the company invested heavily in inventory and R&D for new product ramps.

Key Product Launches Ramping

Client SSDs

- SM2508: 6nm 8-channel PCIe Gen5 controller with 14GB/s sequential and 3.5W power consumption

- SM2504XT: Mainstream 6nm 4-channel DRAM-less PCIe Gen5 for mainstream PCs

- SM2322: External USB 3.2 portable SSD controller for AI smart devices and gaming consoles

- SM2264XT-AT: PCIe Gen4 automotive controller with ASPICE L3 certification

Enterprise/AI

- SM8366: 16-channel PCIe Gen5 with MonTitan architecture

- SM8308: 8-channel PCIe Gen5 for data center

2026 Segment Revenue Targets

Management provided specific guidance on segment contributions exiting 2026:

The company expects sequential growth every quarter in 2026 and a record revenue year, despite operating expense headwinds from the 4nm tape out in Q2.

What to Watch Next Quarter

- Boot Drive Revenue: BlueField 3 volume shipments contributing ~$50M this year, next-gen DPU/switch qualifications ongoing

- MonTitan Qualifications: TLC-based compute SSD end-user qualification progressing in H1, commercial ramp in H2

- DRAM-less PCIe 5: 4-channel SM2504XT ramping significantly as DRAM shortage constrains 8-channel adoption

- 4nm Tape Out: PCIe 6 MonTitan scheduled for Q2 2026, driving higher OpEx

- Automotive Expansion: Target 10% of revenue by year-end, dependent on NAND procurement

The Bottom Line

Silicon Motion delivered a clean beat on revenue with guidance that blew past Street expectations by over 25%. The announcement of production shipments to a leading AI GPU maker (NVIDIA's BlueField DPUs) validates the company's datacenter/AI pivot and opens a ~$50M revenue stream this year with "much higher" potential in 2027.

Key 2026 catalysts are now clearly defined: MonTitan targeting 5-10% of revenue exiting the year, automotive scaling to 10%, and the 4nm PCIe 6 tape out positioning the company for 2027-2028 hyperscaler wins. The company's structural advantage—long-standing NAND maker relationships and TSMC access that Chinese competitors lack—positions it to gain share even as memory supply tightens.

While the slight EPS miss reflects heavy R&D investment, the margin trajectory remains on track (full-year 2026 operating margins expected to improve vs. 2025). The stock's 9%+ after-hours move suggests investors are looking through near-term noise to the multi-year AI and enterprise opportunity ahead.

Explore More